Realized PnL: What It Is and How to Calculate It

Learn what realized PnL is, how to calculate trading profits accurately, manage risk, and evaluate real trading performance.

Realized PnL refers to the profit or loss that becomes final once a trading position is closed. When a trader exits a position either manually, via stop-loss, or through liquidation the resulting profit or loss is "realized" and added to or deducted from the trading account.

Key Characteristics of Realized PnL

It is final and irreversible

It directly impacts account equity

It is used for performance evaluation

It is taxable in many jurisdictions

Once PnL is realized, it no longer depends on market movements.

Realized PnL vs Unrealized PnL

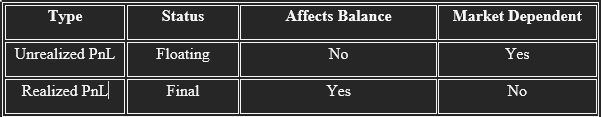

Understanding the difference between realized and unrealized PnL is crucial.

Unrealized PnL

Unrealized PnL refers to the floating profit or loss of an open position. It changes continuously with price movements and is not yet added to the account balance.

Realized PnL

Realized PnL is recorded only after closing the position and reflects the final outcome of the trade.

Why Realized PnL Matters

Accurate Performance Measurement

Realized PnL provides a clear and honest picture of trading performance. It shows what has actually been earned or lost not what could have been earned.

Strategy Evaluation

Professional traders rely on realized PnL to assess whether a trading strategy is profitable over time.

Capital Management

Since realized PnL directly changes account balance, it determines available margin, position size, and future risk capacity.

How Realized PnL Is Calculated

The basic formula for realized PnL is:

Realized PnL Formula

Realized PnL = (Exit Price − Entry Price) × Position Size − Fees

For short positions, the formula is reversed.

Example: Long Trade

Entry Price: $20,000

Exit Price: $21,000

Position Size: 0.5 BTC

Trading Fees: $50

Realized PnL = (21,000 − 20,000) × 0.5 − 50 = $450 profit

Example: Short Trade

Entry Price: $30,000

Exit Price: $28,000

Position Size: 0.2 BTC

Fees: $40

Realized PnL = (30,000 − 28,000) × 0.2 − 40 = $360 profit

Realized PnL in Leveraged Trading

In leveraged trading, realized PnL is magnified because profits and losses are based on full position size, not margin.

Key Points

Higher leverage increases realized PnL swings

Liquidation results in realized loss

Funding fees affect final PnL

Even small price movements can generate large realized profits or losses when leverage is applied.

Impact of Fees on Realized PnL

Trading fees play a critical role in realized PnL, especially for high-frequency traders.

Common Fees Affecting PnL

Maker and taker fees

Funding fees (perpetual futures)

Withdrawal fees

Ignoring fees can lead to overstated performance results.

Realized PnL and Risk Management

Stop-Loss Orders

Stop-losses help control realized losses by exiting trades before losses grow too large.

Position Sizing

Smaller position sizes reduce the volatility of realized PnL and improve consistency.

Risk-Reward Ratios

A positive risk-reward ratio ensures long-term profitability even with moderate win rates.

Using Realized PnL to Improve Trading Strategies

Professional traders analyze realized PnL over time to identify strengths and weaknesses.

Metrics Derived from Realized PnL

Win rate

Average profit per trade

Average loss per trade

Maximum drawdown

These metrics guide strategy optimization and decision-making.

Realized PnL in Algorithmic and AI Trading

In algorithmic trading and AI trading systems, realized PnL is the primary metric used for backtesting and live performance evaluation.

AI systems optimize strategies based on:

Long-term realized profitability

Drawdown control

Consistency across market conditions

Common Mistakes When Interpreting Realized PnL

Ignoring fees and funding costs

Comparing unrealized gains to realized results

Overtrading to increase PnL

Taking excessive risk after profits

Avoiding these mistakes improves trading discipline.

Tax Implications of Realized PnL

In many countries, realized PnL is taxable income. Traders should:

Keep detailed trading records

Understand local tax regulations

Consult financial professionals if needed

Unrealized PnL is typically not taxed until realized.

Realized PnL is the most reliable measure of trading success. It represents the true outcome of trading decisions and directly impacts account growth. Whether trading crypto, forex, or futures, understanding how to calculate and analyze realized PnL is essential for performance evaluation and risk management.

By focusing on consistent realized profits, managing fees, and controlling risk, traders can build sustainable strategies and improve long-term results in volatile financial markets.